Condo Insurance in and around Auburn

Condo unitowners of Auburn, State Farm has you covered.

Quality coverage for your condo and belongings inside

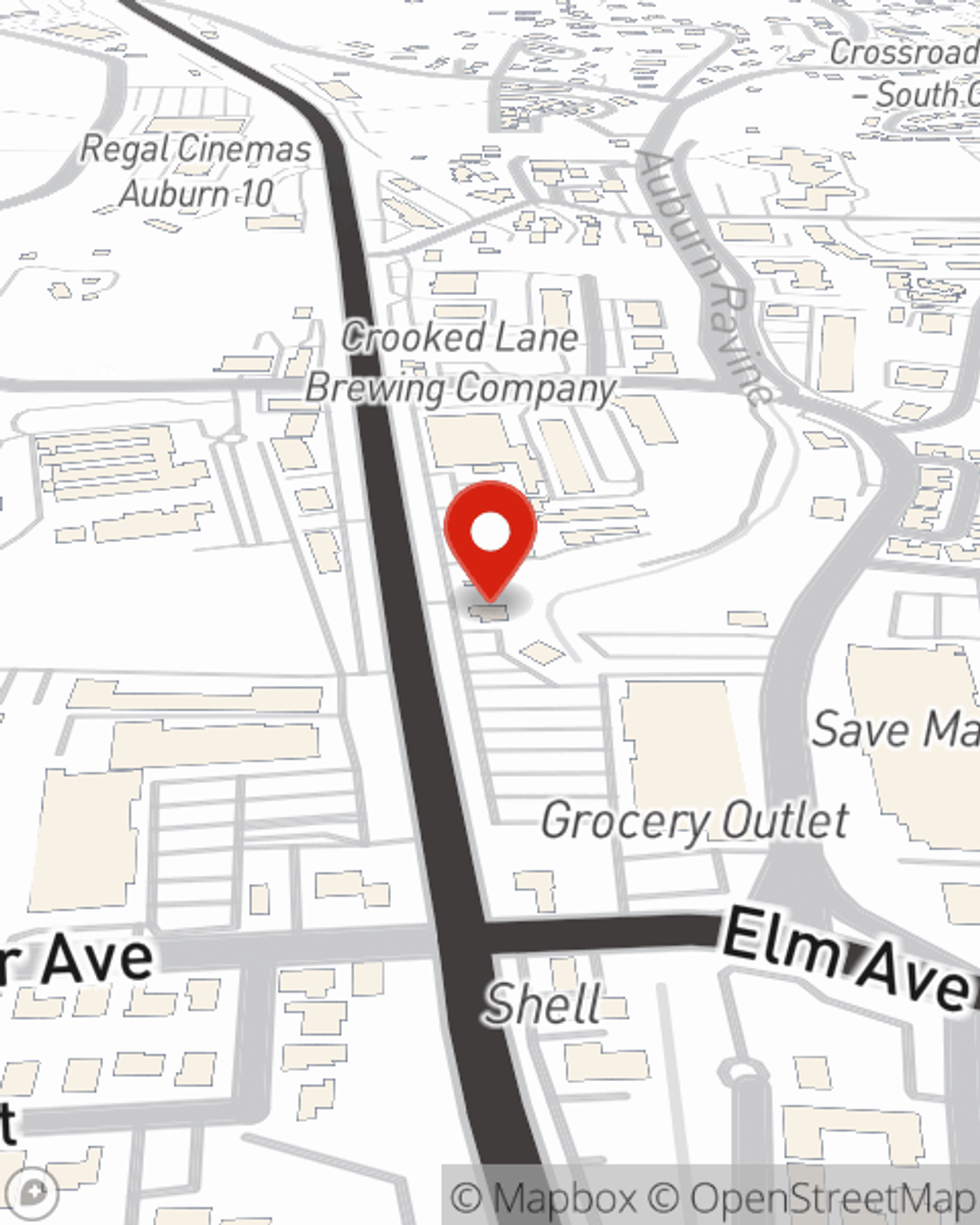

- Auburn

Home Is Where Your Condo Is

Looking for a policy that can help insure both your condominium and the souvenirs, cookware, clothing? State Farm offers excellent coverage options you don't want to miss.

Condo unitowners of Auburn, State Farm has you covered.

Quality coverage for your condo and belongings inside

Condo Unitowners Insurance You Can Count On

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condominium from a hailstorm, water damage or fire.

There is no better time than the present to contact agent Ralph Smith and learn about your condo unitowners insurance options. Ralph Smith would love to help you select the smartest policy for you.

Have More Questions About Condo Unitowners Insurance?

Call Ralph at (530) 885-8652 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Ralph Smith

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.